How to Lower Your Car Insurance Rates

You can save by taking a look at your current policy. Here are the key moves to make and when to switch insurers.

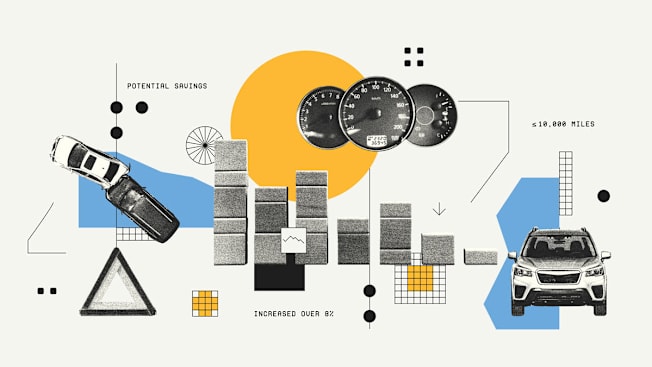

You’ve probably seen your annual car insurance premium go up over the past few years. Most people have. In the first half of 2025 alone, rates have increased by over 8 percent according to the Bureau of Labor Statistics, and that number has increased by over 30 percent since 2023.

There are several factors contributing to those soaring prices. The number of car crash injuries and fatalities remains high, along with the attendant litigation costs. Severe weather, such as flooding and wildfires, can damage cars. To make matters worse, the cost of repairing vehicles is near an all-time peak. But there are steps you can take to keep those problems from increasing your insurance bill. Read on for the best ways to save on car insurance.

Examine Your Policy

Major life changes like the ones here affect how much coverage you need. Adjusting your policy accordingly could lower your premium.

You’re Driving Less

Most insurance companies include annual mileage in their pricing methodology, and letting your insurer know you’re now driving fewer miles can save money. Clocking less than 10,000 miles per year, for example, can save you an average of about $116 on your annual premium.

Seek Out More Savings

Once you’ve determined the specifics of the coverage you need, look for other ways to cut costs.

Raise Your Deductible

Potential Savings: $509 to $636 a year*

You probably know that a higher deductible will lower your premium, but you might be surprised by how much. On average, increasing it from $500 to $1,000 can reduce your premium by 20 to 25 percent.

Drop Collision Coverage

Potential Savings: $300 to $800 a year

Collision insurance pays for the cost of repairing or replacing your car if it’s damaged in a crash. That includes collisions with other vehicles, single-car incidents, and hit-and-run crashes. As your car ages and loses value, it may no longer make sense to pay for this coverage. CR recommends dropping collision when your premium is more than 10 percent of the vehicle’s value. That value depends on mileage, age, and wear. You can look up your specific model at CR.org/tradein.

Bundle Auto and Home Insurance

Potential Savings: $382 a year

Some companies will give you a discount for purchasing both your home and auto policies from them. Ask about the possible savings.

Take a Defensive Driving Course

Potential Savings: $254 a year

Some insurers will provide a price reduction for taking a safe-driving course every few years. Many can be completed online, and costs vary. In New York, for example, motorists can receive a 10 percent discount on their insurance after taking a state-approved defensive driving course that costs $25 and takes about 5 hours once every three years.

*Calculations drawn using 2024 numbers compiled by Bankrate and information from the Insurance Information Institute.

Shop Around

Start by asking your current insurer to adjust your plan to account for the tweaks you are making—driving fewer miles, accepting a higher deductible, etc. Once they’ve given you a new price, follow the advice below to reach out to several other insurers to see whether they can do better. According to CR’s 2024 survey of over 40,000 Americans with car insurance, you are likely to find significant savings this way. Respondents who switched insurers saw a median annual savings of $461.

Review Comparison Sites

There are a number of one-stop-shop online services that allow you to get and compare quotes from multiple car insurance companies. Chuck Bell, CR’s programs director for advocacy, says that Compare.com, Experian, Insurify, Jerry, Policygenius, Way, and The Zebra are dependable and fairly comprehensive, although no one site can compare every insurer at once. Avoid CarInsurance.com, EverQuote, Insurance.com, Insure.com, and QuoteWizard. Those sites are known to sell users’ personal details to insurance companies and brokers, so sharing information with them may lead to unexpected calls, emails, and texts.

Ask an Independent Agent

Independent insurance agents offer access to smaller regional insurers that don’t always show up on the big comparison sites. These companies can build region-specific plans that may be a better overall value, and they may provide better customer service than larger national providers. You can find these types of agents at the Independent Insurance Agents & Brokers of America website, but word of mouth is often the best way to connect with a good one.

Consider a Mutual Insurer

Mutual insurance companies are owned by their policyholders and typically offer what are called dividend policies. Premiums may cost the same as standard plans, but they offer annual rebates when the company performs well financially. NJM, State Farm Mutual, and USAA operate this way. Amica—a top-rated insurer in CR’s ratings—offers a dividend policy with an annual kickback to policyholders of between 5 and 20 percent—savings of $127 to $508, on average.

Consult CR’s Ratings

Once you’ve received quotes from a few insurers, use our ratings to identify the top-rated among them. Pay attention to factors beyond just the cost. An insurer with low rates may have poor claims performance, which is also important.

Will Driver Monitoring Lower Your Costs?

Many insurers now offer a discount if you enroll in a telematics program, which tracks your driving—capturing data such as speed, braking, time of day, and location—through a smartphone app or a device that plugs into your car. If your insurer considers you a safe driver, there’s a potential for big savings—around $1,000 annually, although most people save more like $250. If the insurer doesn’t like what it sees, your premium could increase.

Ask these questions before saying yes to telematics: What data is used to calculate my discount? How is it analyzed? Will it be used in other ways? If you want to keep your data super-secure, you may find that the possible savings isn’t worth it.

Need Car Insurance?

See our car insurance ratings and buying guide.

Editor’s Note: This article originally appeared in the April 2025 issue of Consumer Reports magazine.