How to Navigate Today's Elevated New-Car Prices

Transaction prices continue to be high, but inventory and incentives are plentiful—if you know where to look.

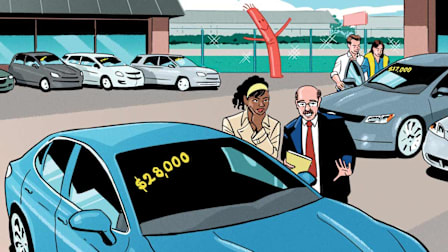

New-car prices are hovering around record highs, with the average transaction price now above $48,000, and the average loan rate well over 6 percent (if you have great credit). The silver lining, say analysts, is that new-car inventory is generally robust and incentives are once again plentiful.

Why Do New Cars Cost So Much?

In a word: inflation. But the story is more complex than that. In the years following the pandemic, parts and production delays made it difficult for automakers to meet consumer demand. So they prioritized popular, higher-profit models such as trucks and SUVs, often laden with the latest and greatest in optional equipment packages.

Inflation has slowed, and auto manufacturing again hums along at a steady clip. But more expensive prices for parts and labor, along with the fact that dealership lots are more likely to be filled with cars packed with options that can add thousands of dollars to the base price, have all increased the amount consumers pay for a new car, on average. Pat Ryan, founder of CoPilot, an AI-powered car-buying app, says that new-car prices are 30 percent higher than in March 2020, when the pandemic-related economic turmoil began.

What to Do About It

Times are tough, but there’s no reason to lose hope. By following these key strategies, you can proactively eliminate some of the roadblocks you will face along the way, easing the search and purchasing process.

Get prequalified. This is good advice during the best of times, but especially now, according to Credit Karma, an organization that helps car buyers get a credit score and keep track of their personal auto financing. Getting prequalified gives the buyer a leg up in a negotiating process that is currently skewed in the seller’s favor. Because you’re likely to be paying more than usual for a car, the best deals to be found are in financing. (Learn how to shop for a car loan.)

Cast a wider net. If you’re searching local dealerships, look outside your immediate area for more options. You can also shop for cars using a number of online search tools that typically allow you to specify the distance you’re willing to travel to make a deal.

Leverage your existing car. Used-car prices have eased over the past couple of years, but dealers are still hungry for used cars to sell to budget-minded shoppers who might not be able to afford new-car payments. That means that selling or trading in your old car can make a significant dent in the price of your new car.

Look for incentives. Check dealership and manufacturer websites for local and national incentives such as cash-back offers, low-rate financing, and lease deals with low monthly payments. (CR updates its best new-car deals list monthly.) Chances are that if you look among less-popular offerings—such as sedans, small hatchbacks, and front-wheel-drive (as opposed to all-wheel-drive) SUVs—you may find attractive deals. If you have an extra car you’re not using much, consider selling it. You’ll save money on annual taxes, registration fees, and insurance premiums, and you can use the money from the sale to help finance a more expensive car now or in the future.

Be flexible. You may want a red 3-row SUV with heated seats and built-in navigation, but if you’re willing to make concessions on color, equipment, and even model, you’re more likely to get a car that fits your needs and your budget. Consumer Reports keeps a running tally on better alternatives to some popular models, and checking out our ratings and reviews can help you find something better if the car you had in mind is too expensive.

Fix your old car. Even an expensive repair like an engine rebuild or a transmission replacement may be worthwhile if you can get a few more years out of an otherwise reliable car. If you’ve fallen behind on routine maintenance, get back on schedule, and stay on top of it so that your vehicle will last until the interest rates come down again. If you can’t decide whether to fix it or move on, CR suggests figuring out how many months you want to keep the car, then dividing the cost of the repair by that many months. The monthly amount for the repair could be cheaper than the monthly payment on a new car (especially when you factor in the rising cost of car insurance). If you don’t have enough money to pay for a major repair up front, you may be able to find a shop that will finance the work. (See our guide to car maintenance and repair.)

Refinance your old car. If you’re inclined to wait for more optimal buying conditions, refinancing your car loan can be a great way to save money if you’ve improved your credit score since you bought your car. Credit Karma has found that consumers can save an average of $3,000—about $55 per month—over the life of the loan by refinancing.